Table of Content

Housing loans were available for 7-8% and real estate prices were rising 15-20%. So it made a lot of sense to buy a property with a cheap loan. Home loans now cost around 10% while property prices are rising by barely 4-5%. In some pockets they have even declined in the past 1-2 years. The EMIs will be lower, given the length of the loan.

It is giving a discount to army men, female applicants and people having salary accounts in their bank. Home loan applicants can choose their repayment schedule based on their financial preferences. There are two major types of home loan tenures - Short-Term Home Loan Tenure and Long-Term Home Loan Tenure.

When can I make a home loan application?

The medical allowance is also excluded from the calculation. This is because these expenses are not derived by an individual with his/her salary. In this case, Chandra will only get these amounts as reimbursements, in case he spends on medical needs or travel requirements. After this step, you will be able to check all the home loan offers that you are eligible for and apply for a home loan. You can also consider using the BankBazaar Home Loan EMI Calculator to calculate your effective EMI amounts for the home loan product that you want to choose. Moreover, insurance policies that are linked to a loan are often single premium plans.

But this tax benefit alone should not be the reason to keep a loan running. True, the tax benefits bring down the effective cost of the loan. But you are still incurring an expense that can be avoided by ending the loan as soon as possible. Unless the money can earn you a better return than the effective cost of the loan, use it to prepay the outstanding sum. A long-term mortgage should never be a sign-and-forget exercise.

How much tax rebate can one get by taking a home loan?

To transfer your rights to take decision on your behalf to your co-applicant you will need a Power of Attorney. For this you would have to visit the Indian Embassy to get it registered from the country you are residing in. The format of the Power of Attorney is not something that you can choose on your own as every lender has their own specified format of the same. Then you will have to send the registered copy to the lender to process your application. Although it is not mandatory to have a co applicant or co-borrower in the guidelines issued by RBI. But most lenders insist on having one as the applicant is not a resident of India and lender may need someone to deal with, if any property related issues crops up.

If you are in between switching your companies, then you must have the joining letter of the company, first month salary slip and relieving letter of the previous company. Detailed Cost Estimate / Valuation Report from approved value in case of outright purchase of an existing house / flat. Copy of identity card issued by the current employer / proof of income in case of self-employed professionals / businessmen. I bought my home loan from Fullerton but an interest rates are high.

Age limit for Home Loan

Since the LTV is 90% of ₹ 16 lac i.e. ₹ 14.4 lac, you can get only ₹ 14.4 lac (not ₹ 17,09,806) as the final home loan amount whose EMI comes to ₹ 13,86 per month. Let us assume the LTV is 90% and the property cost is ₹ 14 lac. Here taking a salary as ₹ 25k, & without any fixed monthly obligation, you can pay a maximum of ₹ 12,500 as EMI considering 50% FOIR. If the interest rate is 10% per annum, the loan amount eligibility can be arrived at ₹ 13,73,026 using a home loan eligibility calculator . Since the LTV is 90% of ₹ 14 lac i.e. ₹ 12.6 lac, you can get only ₹ 12.6 lac (not ₹ 13,73,026) as the final home loan amount whose EMI comes to ₹ 12,159 per month. Let us assume the LTV is 90% and the property cost is ₹ 10 lac.

The EMIs are often higher for short-term loans because they are dispersed over a shorter period. However, the total interest paid is lower than a long-term home loan. Even if you earn a very handsome salary, a poor credit score can negatively impact your chances of getting a home loan. Generally, financial institutes prefer a credit score of more than 650. A credit score above 750 can also give you an upper hand to bargain for lower home loan interest rates.

Tranche Based EMI

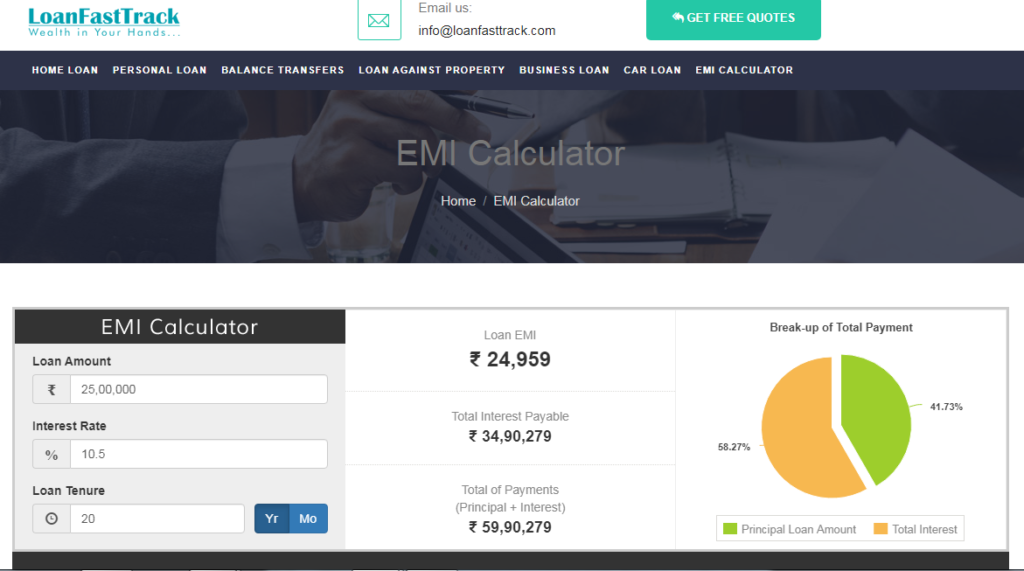

While comparing, consider the interest rate, Loan-to-Value ratio, processing fees, and tenure offered by the bank. Use a home loan EMI calculator and calculate your EMI based on these factors. Compare multiple home loan products by various banks by using this method.

Now assuming you bought a property for 50 lacs and paid interest of 35 lacs then your cost of the property is 85 lacs instead of 50 lacs. The higher cost of property means lower ROI from the property. I explained it in detail in my post, 5 Disadvantages of Home Loan. Therefore, i always caution my clients who buy property on Home Loan for investment purpose.

Each bank has specific parameters, based on which they approve a property loan for you. These include age, income, employment status, where you work, what builder you’re buying a house from, etc. Interest rates are competitive and loans are available for the purchase of plots as well. However, you can check the list of home loan documents required for different types of applicants and apply for your loan accordingly. Let us consider that Chandra has no loans or liabilities at present and his net available income is Rs.1,03,400. However, you must always remember that the Leave Travel Allowance is not taken into consideration by the bank when calculating the salary.

The rate of interest was high 9.15% with the duration period of 20 years and i am paying EMI of Rs.24,000 and they given this loan very faster . At an Initial I took home loan from DHFL on sudden from their end transferred the process to INDIA BULLS without any intimation. But one issue was faced that my documents not submitted to INDIA BULLS hence I have submitted again. The rate of interest is started with 8.35% gradually increased hence on last months was 8.90%. Long back ago, i have taken the home loan from GIC Housing finance.

Kotak Mahindra offers a competitive interest rate and is a growing bank in India, though the processing fee for self-employed is 1% but the other parameters are still competitive. Can I get a higher loan through my existing loan account to buy a new property? Yes, you can use your existing loan account to purchase a new property.

There are a number of lenders in India who offer home loans for NRIs. What is the role of co-applicant in home loan eligibility? You can avail a home loan along with a co-applicant to increase the chances of the loan approval. The main role of a co-applicant is to repay the home loan along with you .

There is a rebate of 0.10% for women applicants buying properties in their names and a rebate of 0.5% for people having their salary account in the bank. UCO Bank’s home loan comes with a low interest rate and the range of interest rate for various credit scores does not differ much. At this point the interest rate ranges between 8.40% to 8.60%. Home loans can be divided into various categories depending on their features like interest rates, availability, extra charges etc. Choosing a home loan at a time when the market is flooded with multiple options can be daunting.

No comments:

Post a Comment